Are you facing difficulty while trying to change tax rates in QuickBooks? If yes, then you don’t have to worry anymore. In this post we have described how to change the tax rate in QuickBooks. It is necessary to change the tax rate in QuickBooks because the tax rate changes over a period of time. Therefore, changing them is mandatory so you can easily calculate the tax rate without any discrepancy.

To know about the detailed instructions on how to change tax rates in QuickBooks Desktop and Online, you must have a look at this entire post thoroughly.

Why is It Necessary to Change Tax Rates in QuickBooks?

If you are a regular user of the QuickBooks application to manage your day-to-day business activities, then you must be updated about the financial authorities also. But those users who have recently added the sales tax in QuickBooks must be aware that the financial authorities change the tax rate over a period of time. Therefore, one must update the sales tax rate in QuickBooks Online so that they can calculate the tax rate easily.

Facts you must know before changing a sales tax rate in QuickBooks

It is mandatory that you must consider a few things in your mind before you change tax rates in QuickBooks.

- The changes done in the tax rate will automatically update the rates everywhere except in your previous transactions.

- Once you have changed the tax rate, you can’t use the rate that was used earlier.

- If you have generated a new transaction but use the old dates, the transaction will automatically use the new rate.

- For instance, if you have made any change in the sales tax rate on a template, you have to edit your template again. This is necessary so that you can add the updated sales tax rate properly.

- The existing transactions that are accessing the older rates remain unchanged unless you change the transactions and choose a different sales tax rate.

- The reports will represent the data of both rates when transactions for both rates are listed within a particular period.

Also Read – How to Delete a Payment in QuickBooks

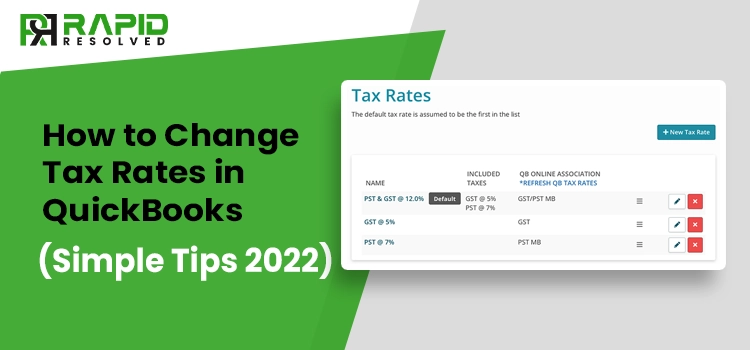

How can I change the sales tax rate in QuickBooks?

Editing the sales tax rate in the QuickBooks software is an essentially manual process. The users may make changes in the sales tax rate on any device on which they are accessing the QuickBooks accounting software. You may change the tax rate in QuickBooks Desktop and in QuickBooks Online.

Below we have explained step-by-step instructions to change the tax rate in QuickBooks Online and Desktop versions. Perform the steps accordingly.

1. Steps to Edit your sales tax rate in QuickBooks Online

While utilizing the automated sales tax feature, QuickBooks automatically creates the tax agencies and the sales tax required. However, if you are using the custom sales tax rates, you can edit it manually by performing the steps listed below.

A. Edit Sales Tax Rate through Manual Sales Tax

- To initiate the process, move to the Taxes option followed by the Sales tax.

- After this, opt for the Sales Tax Settings option.

- Now, you must look for the sales tax rate you want to modify from the Custom rate section.

- Further, choose the Edit option and then add the name or rate as per your wish.

- In the end, tap on the Continue option and then pick the Edit option.

If you utilize the manual sales tax, perform the following instructions to make changes to your sales tax rate.

Also, you can read – Reset QuickBooks Admin Password

B. Edit Sales Tax Rate through the manual sales tax

While making changes in a sales tax rate, all the prevailing transactions that use the old tax rate will not change. The updated sales tax rate will only be applicable to new transactions. Below, we have listed the steps to edit the sales tax, go through it.

- Move to Taxes and then opt for the Sales Tax option.

Now, you are required to tap on the Add/edit tax rates and agencies below the Related Tasks. - Next, you have to pick the rate you wish to change from the Sales Tax Rates and Agencies table. Further, choose the Edit option.

- You are supposed to edit the tax rate that you wish to change. Moreover, you may also make changes to the component name if required.

- Finally, choose the Save option, and you will see that the sales tax rate is changed successfully.

2. Steps to Change tax rates in QuickBooks Desktop

If you don’t know how to change tax rates in QuickBooks Desktop, don’t worry. Below we have provided you with the stepwise instructions to edit the sales tax rates in QB; go through it.

- In the initial stage, move to the Lists in the menu bar and pick the Item List from the drop-down menu.

- Now, you have to opt for one of the tax rates you want to change, right-click on it and then click on the Edit Item.

- After this, you need to edit your tax rate.

- In the end, tap on the Ok option to save the desired changes successfully.

3. Procedure to Edit a Tax Agency Name:-

The users can edit the tax agency name via Tax Sales Center using the manual tax only. However, your sales form will still represent the old or initial name that you have added.

- In the initial stage, click on the Taxes option followed by Sales Tax.

- Now, you have to navigate for the tax agency that you want to change from the Agency Name column. Then, choose the Rename option and move toward the next step.

- Afterwards, you must add a new name and opt for the Save option.

Winding Up

We assure you that this post will definitely help you to change the tax rates in QuickBooks Online and Desktop easily. However, if you get stuck while performing any of these steps to edit the sales tax rate in QB and need immediate help, don’t worry. You can consult with one of our highly-certified experts through a live chat person at QuickBooks. The experts will guide you with stepwise instructions so you can easily make changes to the tax rate without any hassle.